- Supply disruptions have dampened the strength of the rebound in global merchandise trade, but this could be starting to change as supply chain pressures show signs of easing

- Loss of momentum in trade noted in January after strong rebound in 2021 volumes. But signs of bottoming out are emerging, suggesting a rebound in merchandise trade soon

- Container shipping index fell further below trend due to port congestion, but its slowing rate of decline could signal a turnaround as box throughput are at a very high level at major ports

Supply disruptions have dampened the strength of the rebound in global merchandise trade, but this could be starting to change as supply chain pressures show some signs of easing, the latest World Trade Organization Goods Trade Barometer shows.

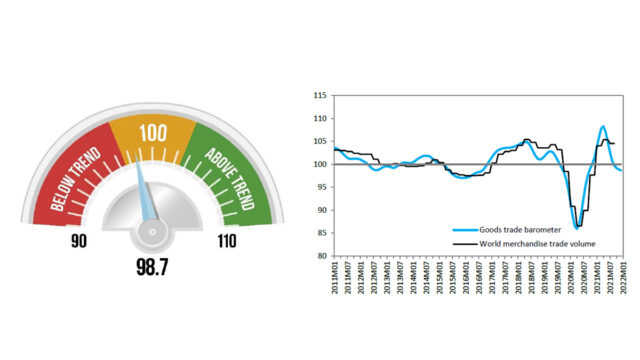

The current reading of 98.7 is below the barometer’s baseline value of 100 and down slightly from last November’s reading of 99.5, the WTO said in a report on February 21.

This indicates a loss of momentum in trade at the start of 2022 after a strong rebound in trade volumes in 2021, the organization said. However, the index also shows signs of bottoming out, suggesting that merchandise trade may turn up soon even if it remains below trend in the near term, WTO said.

For instance, the container shipping index (97.2) dipped further below trend as port congestion remained an ongoing problem, but its slowing rate of decline could presage a turnaround in the near future, WTO said. It cited the plateauing of container throughput at a very high level at major ports.

The global trade body said in addition to ongoing supply chain disruptions, the barometer’s weakness is partly explained by the introduction of health restrictions to combat the Omicron wave of COVID-19, which some countries are now scrapping since the new variant’s health impact has turned out to be relatively mild.

“Relaxing these measures could boost trade in the coming months, though future variants of COVID-19 continue to present risks to economic activity and trade,” WTO said.

In the third quarter of 2021, merchandise trade volume growth slowed to 8.1% year on year due to base effects – trade had begun to recover in the second half of 2020 – and a small quarter-on-quarter decline.

The world body said once statistics become available for the fourth quarter of 2021, they are likely to show even lower year-on-year growth, even if quarter-on-quarter growth turns positive again.

Cumulatively, trade volume in the first three quarters of 2021 had risen 11.9% compared with the first three quarters of 2020. WTO said this is above its most recent forecast of 10.8% from last October, but slower year-on-year growth in the fourth quarter should bring the increase for the year more in line with the forecast.

Most of the barometer’s component indices were close to their baseline value of 100, indicating on trend growth, the main exceptions being automotive products (92.0) and container shipping (97.2).

The automotive products index has actually improved compared with recent months due to the gradually increasing availability of semiconductors, which are used extensively in vehicle production. This is reflected in the electronic components index (98.6), which is close to trend.

Purchasing managers indices show delivery times coming down gradually worldwide, but not fast enough for many producers and consumers.