- Production and supply disruptions and cooling import demand are dampening the growth of merchandise trade

- The current barometer reading suggests that merchandise trade volume growth will slow down in the second half of the year

- All of the barometer’s component indices were declining in the latest period, reflecting a broad loss of momentum in global goods trade

Global merchandise trade is slowing after its sharp rebound from the initial shock of the COVID-19 pandemic, with production and supply disruptions and cooling import demand dampening growth, according to the World Trade Organization’s (WTO) latest Goods Trade Barometer.

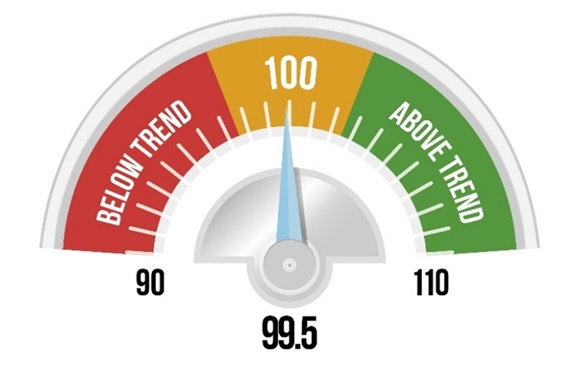

The latest barometer reading of 99.5 issued on November 15 signals a return to recent growth trends. This follows the record reading of 110.4 in the previous barometer issued in August, which reflected both the strength of the trade recovery and the depth of the pandemic-induced shock last year.

As expected, merchandise trade recorded a strong year-on-year increase in the second quarter, up 22.4% due to the recovery of demand for imported goods and the depth of the trade slump in 2020 during the first wave of the pandemic.

The current barometer reading suggests that merchandise trade volume growth should slow in the second half of the year. This is consistent with the WTO’s most recent trade forecast of October 4, which foresaw global merchandise trade volume growth of 10.8% in 2021 followed by a 4.7% rise in 2022.

The forecast also showed quarterly trade growth slowing in the second half of 2021 as the volume of merchandise trade volume approached its pre-pandemic trend.

Contributing to the latest barometer’s decline have been the recent supply shocks, including port gridlock arising from surging import demand in the first half of the year and disrupted production of widely traded goods such as automobiles and semiconductors.

Demand for traded goods also appears to be easing, as illustrated by falling export orders, which further weighed down the barometer. Cooling import demand could help ease port congestion, but backlogs and delays are unlikely to be eliminated as long as container throughput remains at or near record levels.

All of the barometer’s component indices were declining in the latest period, reflecting a broad loss of momentum in global goods trade.

The steepest decline was seen in the automotive products index (85.9), which dropped below trend as a shortage of semiconductors hampered vehicle production worldwide.

This shortage was also reflected in the electronic components index (99.6), which fell from above trend to on trend.

Indices for container shipping (100.3) and raw materials (100.0) also returned to near their recent trends.

Only the air freight index (106.1) remained firmly above trend as shippers sought substitutes for ocean transport.

The outlook for world trade continues to be overshadowed by considerable downside risks, including regional disparities, continued weakness in services trade, and lagging vaccination rates, particularly in poor countries. COVID-19 continues to pose the greatest threat to the outlook for trade, as new waves of infection could easily undermine the recovery.

The WTO’s Goods Trade Barometer is a composite leading indicator providing real-time information on the trajectory of merchandise trade relative to recent trends ahead of conventional trade volume statistics. It is released on a quarterly basis depending on data availability. The overall index and the component indices measure short-run deviations from recent (i.e. medium term) trends. Recent trends serve as baselines for each index, which are normalized to be equal to 100.

Image from WTO website