- IMF cuts global GDP forecast due to Ukraine conflict

- The global economic growth forecast is down to 3.6% this year and next, a drop of 0.8 and 0.2 percentage point, respectively, from the January forecast due to the war’s direct impacts on Russia and Ukraine and global spillovers

- The crisis lender warns that rising inflation due to supply-demand imbalances and could spark social unrest, and China’s lockdowns could cause new global supply chains pains

- New Western sanctions on Russia to tighten its energy exports would cut GDP growth 2% further

The Russia-Ukraine war and the damage it is causing the world economy has led the International Monetary Fund to revise downward its forecast for global economic growth by nearly a full percentage point to 3.6% this year and next, a drop of 0.8 and 0.2 percentage point, respectively, from its January forecast.

In its “World Economic Outlook, April 2022: War Sets Back the Global Recovery” released on April 19, the IMF said war in Ukraine has triggered a costly humanitarian crisis that demands a peaceful resolution.

At the same time, economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and add to inflation, the report said. A further tightening of Western sanctions on Russia targeting energy exports would cause another major drop in global output.

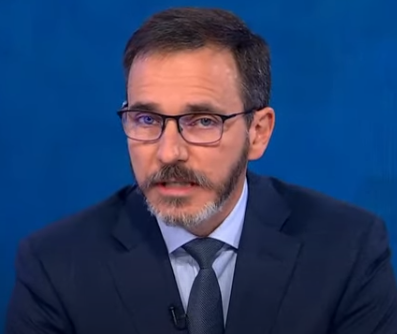

Pierre Olivier Gourinchas, director of research at IMF, said in his foreword to the report that the crisis, which will be two months old on April 24, “is like seismic waves (whose) effects will propagate far and wide”.

He said reduced supplies of oil, gas and metals produced by Russia and wheat and corn produced by Russia and Ukraine had driven up sharply prices in Europe, the Caucasus, Central Asia, the Middle East and South Africa. But those hard-hit are lower-income households around the world.

Rising inflation in many countries due to supply-demand imbalances and policy support during the pandemic could trigger social unrest, while China’s lockdowns in COVID-19-stricken areas could cause new bottlenecks in global supply chains, the report said.

“Compared with our January forecast, we have revised our projection for global growth downwards to 3.6% in both 2022 and 2023. This reflects the direct impact of the war on Ukraine and sanctions on Russia, with both countries projected to experience steep contractions,” the report said.

“This year’s growth outlook for the European Union has been revised downward by 1.1 percentage points due to the indirect effects of the war, making it the second largest contributor to the overall downward revision.”

Fuel and food prices have increased rapidly, hitting vulnerable populations in low-income countries hardest. Global growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023.

“This is 0.8 and 0.2 percentage points lower for 2022 and 2023 than projected in January. Beyond 2023, global growth is forecast to decline to about 3.3% over the medium term,” the report said.

The report said war-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7% in advanced economies and 8.7% in emerging market and developing economies – 1.8 and 2.8 percentage points higher than projected last January.

The IMF said multilateral efforts to respond to the humanitarian crisis, prevent further economic fragmentation, maintain global liquidity, manage debt distress, tackle climate change, and end the pandemic are essential.

Outside Ukraine, advanced economies are expected to fare worse than developing ones – the IMF expects advanced economies to grow at an average rate of 3.3% in 2023 and 2.4% the year after as developing market economies grow at 3.8% and 4.4% in the same period.

The United States GDP growth is expected to perform close to the average for other advanced economies, and notably worse than China’s. US GDP is expected to grow 3.7% in 2022 and then slow to 2.3% growth in 2023, while China’s GDP growth for those years is predicted to be 4.4% and 5.1%, respectively.

But Gourinchas notes that the latest lockdowns in China indicate that growth is not guaranteed.

“With continued tight policies toward the real estate sector and the possibility of more widespread lockdowns as part of the strict zero-COVID strategy, China’s economy could slow more than currently projected – with consequences for Asia and beyond,” including in developing economies, he said.

The IMF said inflation could remain higher for longer due to war-induced commodity price increases and broadening price pressures. It warned the situation could get worse if supply-demand imbalance deepened.

“Inflation has become a clear and present danger for many countries,” Gourinchas said.