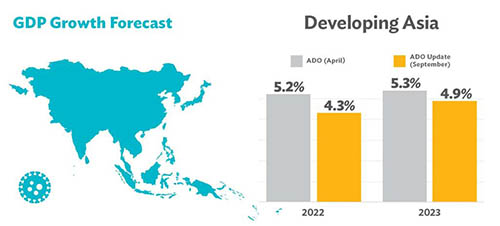

- Asian Development Bank downgrades growth forecast for developing Asia and the Pacific to 4.3% in 2022 from the previous 5.2% forecast, according to the bank’s latest report

- Developing Asia overtakes China in terms of growth for the first time in more than 30 years

- ADB’s “Asia Development Outlook” for September 2022 says more flexible pandemic policies are allowing activity to expand, encouraging consumer spending and hiring

- The Philippines and Indonesia will be at the forefront of growth this year and next

Asian Development Bank downgraded its growth forecast for developing Asia and the Pacific to 4.3% in 2022 from its 5.2% forecast in April, according to the Asian Development Outlook released on September 21.

Excluding China, the projected growth this year and next is 5.3%. These are faster than the 3.3% forecast for China this year and 4.8% next year, the first time in more than three decades that developing Asia will outgrow their giant neighbor.

For Southeast Asia, ADB raised its forecast growth for this year to 5.1% from 4.9%. For 2023, the region is expected to see a 5.0% expansion.

The bank said more flexible pandemic policies are allowing activity to expand, but the “zero-COVID” strategy of China is a notable exception”. Consumer spending and employment are picking up amid less mobility restrictions, ADB said.

The Philippines and Indonesia are among the countries leading the growth front. The bank has upgraded its forecast growth for the Philippines to 6.5% this year, from 6.0% in April, due to strong consumer demand and healthy remittances. But the 2023 forecast was kept at 6.3%.

ADB retained its 6.5% and 6.7% forecasts for Vietnam this year and in 2023, while it raised its projection for Indonesia to 5.4% this year from 5.0% in April, and revising its 5.2% forecast for next year to 5.0%.

The emerging economies of Southeast Asia took a gamble last summer by relaxing their pandemic restrictions and opening their borders, defying the impact of Russia’s invasion of Ukraine and aggressive tightening by the Federal Reserve and other central banks to fight inflation.

“Coronavirus disease risks have fallen as economies make further progress on vaccination and booster shots. This is leading to more flexible pandemic containment policies in much of developing Asia, except in China, which is continuing to follow a zero-COVID strategy,” ADB said.

Price pressures

Inflation forecasts for developing Asia were revised up from 3.7% to 4.5% for 2022 and from 3.1% to 4.0% for 2023 on higher energy and food prices. Regional central banks should ensure that they do not fall behind the curve. Risks to the outlook remain elevated.

“Price pressures in developing Asia – while remaining lower than elsewhere in the world – are increasing on higher energy and food prices. The regional inflation forecast is raised to 4.5% from 3.7% for 2022 and to 4.0% from 3.1% for 2023. Several downside risks loom large,” said Albert F. Park, ADB chief economist.

“A sharp deceleration in global growth, stronger-than-expected monetary policy tightening in advanced economies, the war in Ukraine escalating, a deeper-than-expected deceleration in the [China], and negative pandemic developments could all dent developing Asia’s growth over the forecast horizon,” Park said.

“Sustaining the region’s economic growth depends on a vibrant private sector from which dynamic entrepreneurs can emerge to innovate and create many jobs.”

A sharp deceleration in global growth would severely undermine demand for developing Asia’s exports, and stronger-than-expected monetary policy tightening in advanced economies could result in exchange rate depreciations, financial instability, and balance-of-payments difficulties in economies with vulnerable fundamentals, ADB said.

An escalation of the war in Ukraine and its spillovers on global commodity markets would further increase inflationary pressures and slow growth. And a deeper-than-expected deceleration in China due to recurrent lockdowns or problems in the property sector would affect not just China but also economies that are closely linked to it via trade and supply chains, ADB said.