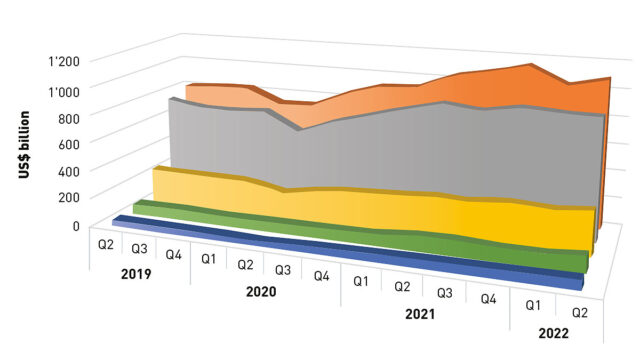

- World exports of intermediate goods (IGs) grew 4% year on year in Q2 2022 to US$2.5 trillion, sharply below the segment’s 47% surge in the same period a year earlier

- The share of IGs in total trade (excluding fuels) in Q2 remained at 50%, a ratio that has been constant over the last decade

- “IG food and beverages” largely contributed to trade growth within supply chains, rising 20% y-o-y and amounting to more than $120 billion

World exports of intermediate goods (IGs) grew 4% year-on-year in the second quarter of 2022 to US$2.5 trillion, driven by an increase in shipments of intermediate food products.

While it lagged by 43 percentage points the 47% surge in the same period a year ago, the overall growth continues to indicate stable activity in global supply chains, the World Trade Organization said in a statement.

The share of IGs in total trade (excluding fuels) remained at 50% in the second quarter of 2022, a ratio that has remained constant over the last decade.

Intermediate goods refer to inputs used to produce a final product and are an indicator of the activity in global supply chains.

The product category “IG food and beverages” largely contributed to trade growth within supply chains, rising 20% y-o-y and amounting to more than $120 billion.

World exports of “other industrial supplies” covering a wide range of manufacturing inputs such as metal structures, electrical conductors, and medical products rose 9% while exports of transport parts and accessories grew 1%.

World exports of ores, precious stones and rare earths, fell 11% y-o-y in Q2 2022, reflecting an iron ore price fall. Imports of Australian iron ore were among the major declines, down 25%.

World exports of IG parts and accessories, excluding transport equipment, declined 1%.

Compared with the first quarter, South and Central America posted the highest IG export growth in the second quarter at 22%, due to Brazil’s massive seasonal soybean exports mainly to China.

Brazil ranked as the 13th largest IG exporter in the second quarter, behind China in first place. The 9% growth observed for North America is linked to the 74 per cent increase in US gold exports, in particular to Europe and Asia.

Similar to global IG growth, the year-on-year rise in most trade flows within and between regions was lower in the second quarter of 2022 compared with previous quarters.

African IG exports to South and Central America rose the most, by 100% y-o-y, among all inter-regional flows. This bilateral trade flow included exports of urea and ammonium from Africa to the fertilizer industry in Brazil.

Moreover, regional IG exports to Africa registered the highest increases. Some regions posted declines: European IG exports to Asia dipped 11% while North American IG exports to Asia fell 4%. African IG exports to North America also slipped 4%.