- Ukraine war, resurgent pandemic to slow Asia growth in 2022

- Asia Pacific is expected to grow to 4.9% this year, 0.5 percentage point less than the IMF January forecast

- Asia Pacific’s advanced economies like Japan and South Korea hit most by lower Europe demand

- Emerging markets reel from impact of higher global commodity prices

- As most of Asia had retreated from COVID-19 peaks, China’s lockdowns in Shanghai and elsewhere threaten to cause further disruptions to regional and global supply chains

Expect economic growth in Asia and the Pacific in 2022 to slow more than previously forecast amid headwinds from the war in Ukraine, a resurgent pandemic, and tightening global financial conditions, according to analysts from the International Monetary Fund.

Anne-Marie Gulde-Wolf, SanjayaPanth and Shanaka J. Peiris say slower growth and rising prices, coupled with the challenges of war, coronavirus infection and tightening financial conditions, will exacerbate the difficult policy trade-off between supporting recovery and containing inflation and debt.

Writing on IMFBlog, a section of the Fund’s website, they said regional GDP will expand 4.9%, 0.5 percentage point less than their January forecast and lags last year’s 6.5% growth. They added that inflation will rise faster in many countries, though from relatively low levels.

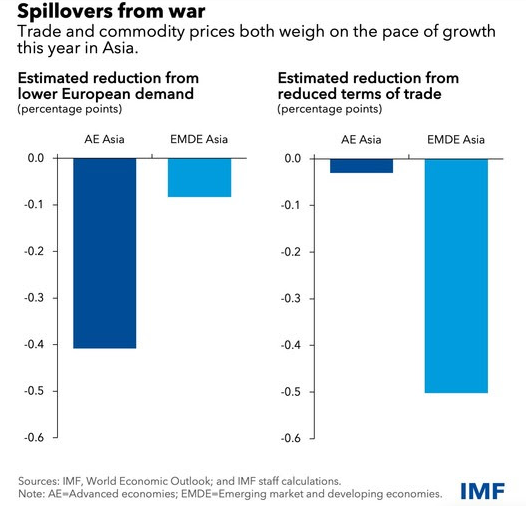

Russia’s invasion of Ukraine poses the biggest challenge for economic growth, with Asia Pacific’s advanced economies, like Japan and South Korea, hurt most by reduced demand from Europe and emerging markets feeling the impact of higher global commodity prices, they said.

“Our latest World Economic Outlook lowered the 2022 global growth estimate by 0.8 percentage point to 3.6%. It reflects a 1.1 percentage point cut for the Euro area, now seen expanding 2.8%. As Asia’s advanced economies have strong ties with Europe, the continent’s weaker growth will weigh on external demand and ultimately growth for major regional trade partners,” they said.

Most of Asia’s emerging and developing economies are net importers of oil, gas, and metals, making them particularly vulnerable to rising global commodity prices, they added.

Deterioration in their terms of trade – a measure of prices for a country’s exports relative to its imports – will likely reduce growth, weaken currencies, and worsen current-account balances. High food and fuel costs adding to inflation pressures will hit lower-income countries where they make up a large share of consumer spending.

The analysts said COVID-19 infections in most of Asia had retreated from their peaks during the rapid spread of the omicron variant, with mobility indicators approaching pre-pandemic levels.

“China is the most notable exception to this, as lockdowns in Shanghai and elsewhere idle a wide range of activity and threaten to cause further disruptions to regional and global supply chains. These lockdowns are one reason that we project growth in China to slow to 4.4% this year, which will affect Asia’s emerging economies through reduced trade and demand,” they said.

Tightening global financial conditions will weigh on economic growth. Government bond yields in major Asian economies have begun rising as the Federal Reserve starts to raise US interest rates. The analysts based their forecasts on expectation tightening abroad and rising inflation at home will lead many Asian central banks to hike rates themselves, placing a drag on investment.

Risks to the economic outlook include an intensification of the three main headwinds. An escalation of the war in Ukraine would further raise food and energy prices, adding to stresses for vulnerable households and potentially causing social unrest to spread to more countries.

A tightening of US monetary policy that is materially faster or larger than expected by markets –or both – would have large spillovers to Asia. If disruptive capital outflows occur as a result, central banks could respond via judicious use of all their policy levers in an integrated fashion.

Finally, a greater slowdown in China’s economy due to broader lockdowns or other risk factors such as the continued weakness in the real estate sector would also have large implications for the region, given trade linkages within Asia.

More broadly, a potential fragmentation of supply chains and added geopolitical tensions will remain risks for the longer term for a region that has flourished in recent decades from rising wealth and other economic gains from globalization.

The analysts said addressing pressures on growth and managing the difficult short-term trade-offs requires strong and coordinated policy responses that are tailored to country-specific circumstances. They said authorities in the region should:

- Protect the most vulnerable from rising fuel and food costs. Social unrest has already flared where these pressures exacerbate vulnerabilities, such as Sri Lanka. Promising regional examples of targeted and temporary protections include a Philippine cash-transfer program and New Zealand’s reduction in public transport fares.

- Anchor medium-term fiscal policy frameworks to ensure debt sustainability. With output gaps still large in many countries, the withdrawal of fiscal stimulus must be well calibrated to support the pandemic recovery. Countries most vulnerable to debt distress will need consolidation sooner, and some may benefit from debt treatment under the Common Framework.

- Tighten monetary policy where inflation is rising faster, such as Singapore, or above central-bank targets, as in Korea. Macroprudential policies should limit financial stability risks amid high household debt levels and address housing price spikes in some countries.

- Enact economic reforms to boost long-term growth. This is important in Asia’s emerging economies, as they may see the most scarring from the pandemic. Overhauls are needed in several areas to boost productivity, such as non-tariff barriers and product and labor markets. Education reforms are essential to address the long-term effects of school closures, which were substantial in South Asia and low-income and developing countries.